Are generational differences impacting your business? Are you communicating effectively?

Not sure how to communicate with your younger coworkers or clients? Looking to attract new clients that don’t fit inside your box?

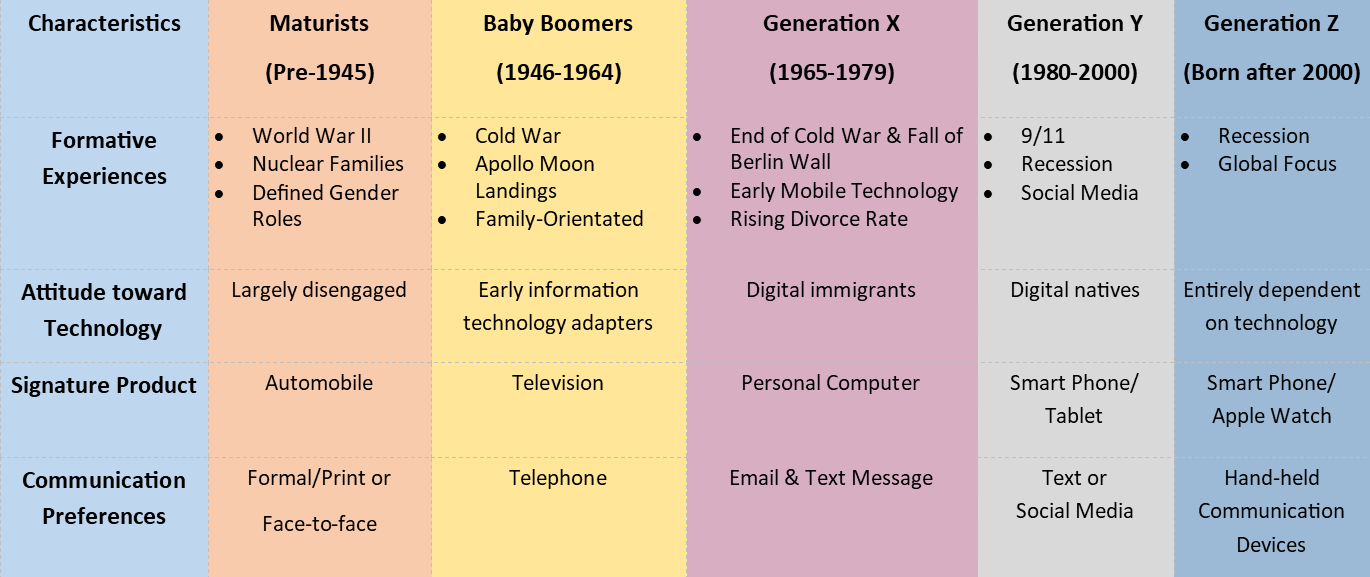

We recently read The Gen-Savvy Financial Advisor by Cam Marston, a guide to better understanding and advising each generation. This book details how to connect with each generation and some of the key differences to be aware of. The four generations include Matures, Baby Boomers, Generation X, and Millennials. This book doesn’t include the up-and-coming Generation Z, but we’ll briefly outline that group below.

Understanding and Advising the Different Generations:

No matter your business, we all are struggling to communicate effectively with the different generations in the workplace. What were some of our takeaways from the book?

- Baby Boomers spent most of their lives competing against others, perfecting their skill sets and cul-de-sacs. As they transition into retirement, they value time and experiences more.

- Boomers are supporting loved ones who are having an even tougher time. When this book was published, it was estimated 74% of Millennials were receiving financial support from a parent or grandparent.

- Gen Xers focus on reducing debt and paying for their children’s education.

- Gen X clients are tough. This generation has questions and wants you to provide proof.

- There’s obvious tension between Gen X and the Baby Boomers. Part of this tension can be attributed to the idea that Boomers are “sticking around” longer and preventing younger groups from moving into the corner office.

- Millennials comprise a large percentage of the population and are projected to control more than $11 trillion in financial assets by 2030.

- Millennials are educated, tech-savvy, and individualistic. Due to the 2008 recession, many are risk averse and postpone life milestones.

Effective Communication Strategies

In addition to the information outlined above, the book does a great job explaining how to communicate with each group based on their preferences, life experiences, and expectations. Let’s look at Gen X clients for example.

- Stay on Message – Avoid unnecessary verbiage & fuss.

- Set Short-term goals – “By the end of today’s meeting, let’s come to some decisions on how to proceed with your allocations.”

- Be the Expert- Provide education materials and learning opportunities.

- Don’t Try to Sell – Be a valuable resource and provide a solution to their unique situation.

This book is quick, and we think you’ll find it helpful.

Need help developing a plan? We can help! Contact us today to get started.