SEC Rule 17a-4 Explained: What RIAs Need to Know About Books and Records

Record-keeping violations are among the most common compliance failures that land firms in hot water with the SEC.

And we’re not talking about small fines. We’re talking about sanctions, penalties, and the kind of regulatory scrutiny that can seriously damage your firm’s reputation and bottom line.

The culprit? SEC Rule 17a-4 — the books and records rule that many advisors think they understand but often get wrong.

If you’re running a firm, you can’t afford to wing it when it comes to books and records compliance. The SEC expects you to know these requirements inside and out, and ignorance isn’t a defense.

Let’s break down exactly what SEC Rule 17a-4 requires and how you can stay on the right side of the regulators.

What Is SEC Rule 17a-4?

SEC Rule 17a-4 is the federal regulation that governs how broker-dealers and investment advisors must maintain their books and records. While RIAs are primarily governed by the Investment Advisers Act of 1940, many of the principles from Rule 17a-4 influence how the SEC evaluates record-keeping compliance across the industry.

The rule isn’t just about what records you need to keep — it’s about how you keep them, where you store them, and how long you retain them.

Here’s what makes this rule particularly tricky: it’s not just about having the records. It’s about having them organized, accessible, and properly maintained according to specific standards.

Core Requirements Under SEC Rule 17a-4

Record Retention Periods

Different types of records have different retention requirements:

Three Years: Most correspondence, trade confirmations, and day-to-day operational records must be kept for at least three years, with the first two years in an easily accessible location.

Six Years: Certain financial records, including general ledgers, trial balances, and other accounting records, must be retained for six years.

Life of the Firm Plus Three Years: Some records, like partnership agreements, articles of incorporation, and minute books, must be kept for the life of the firm plus three years after dissolution.

Storage Requirements

The SEC has specific requirements about how records must be stored:

Write-Once, Read-Many (WORM) Format: Electronic records must be stored in a format that prevents alteration, overwriting, or erasure. This is commonly referred to as WORM compliance.

Duplicate Copies: You must maintain duplicate copies of required records at different locations to protect against loss.

Immediate Access: Records must be readily accessible to regulators upon request. “The dog ate my homework” doesn’t work with the SEC.

What Records Must Be Maintained?

While Rule 17a-4 primarily applies to broker-dealers, RIAs have similar obligations under the Investment Advisers Act. Here are the key categories:

Client Communications

- All written communications with clients

- Email correspondence

- Text messages and other electronic communications

- Meeting notes and phone call summaries

Trading and Investment Records

- Trade confirmations and settlement records

- Investment committee meeting minutes

- Research reports and recommendations

- Performance calculations and supporting documentation

Financial Records

- General ledgers and financial statements

- Bank statements and reconciliations

- Fee calculations and billing records

- Expense reports and supporting documentation

Compliance Documentation

- Compliance policies and procedures

- Training records

- Examination and audit reports

- Exception reports and corrective actions

Rule 204-2: What RIAs Need to Know

RIAs operate under Investment Advisers Act Rule 204-2, not SEC Rule 17a-4. The key difference? RIAs must retain records for five years (first two easily accessible) versus the three-year standard for broker-dealers.

Rule 204-2 covers all investment advisory business records, including client communications, trade records, performance calculations, and compliance documentation. Like Rule 17a-4, electronic records must be safeguarded against loss, alteration, or destruction.

Whether your firm falls under Rule 17a-4 or Rule 204-2, the bottom line is the same: comprehensive, organized, and accessible record-keeping is essential for maintaining compliance.

Common Books and Records Violations

Based on SEC enforcement actions, here are the most frequent violations we see:

Inadequate Email Retention

Many firms fail to properly capture and retain all business-related emails. Personal email accounts, deleted messages, and incomplete archiving are common problems.

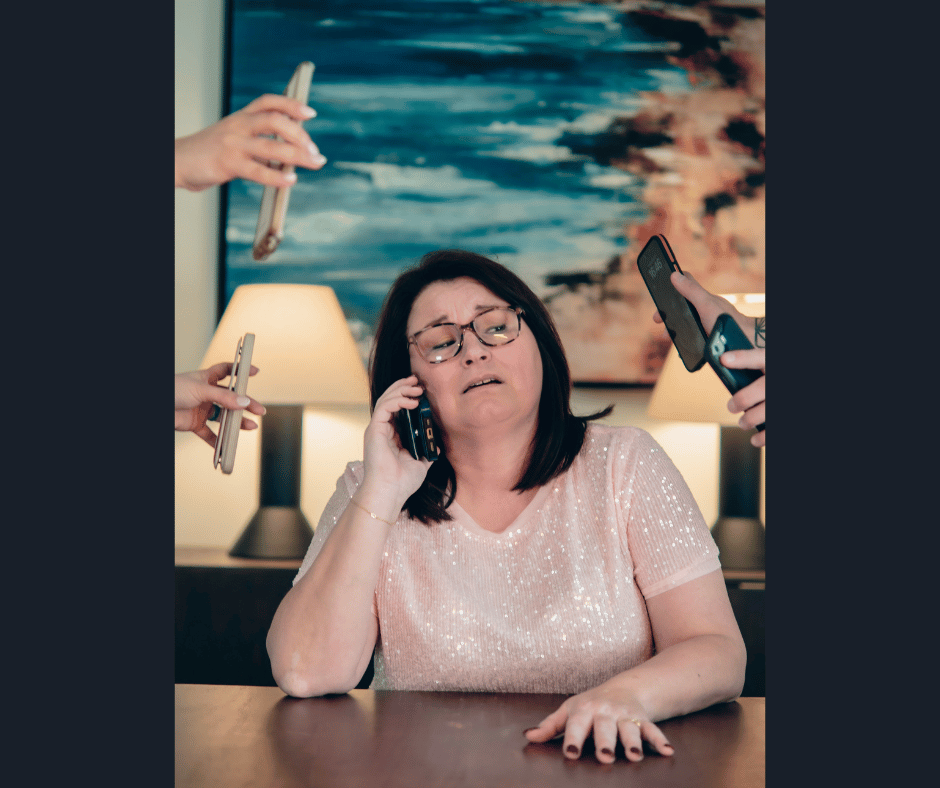

Off-Channel Communications

Employees using personal text messages, WhatsApp, personal email accounts, or other unauthorized communication channels for business purposes create massive compliance gaps. The SEC has issued record-breaking fines for firms that failed to monitor and retain off-channel communications.

Poor Document Organization

Having the records isn’t enough — they need to be organized and easily retrievable. Firms that can’t quickly locate requested documents during examinations face additional scrutiny.

Incomplete Trading Records

Missing trade confirmations, incomplete settlement records, or gaps in trading documentation are red flags for examiners.

Failure to Maintain Supporting Documentation

Keeping the final report but not the supporting calculations, research, or methodology that led to investment decisions is a common oversight.

The Real Cost of Non-Compliance

Record-keeping violations aren’t just technical infractions — they can be expensive:

- Fines and Penalties: The SEC regularly imposes monetary penalties for books and records violations

- Increased Examination Scrutiny: Poor record-keeping leads to more frequent and intensive examinations

- Operational Disruption: Scrambling to locate records during an exam pulls resources away from client service

- Reputational Damage: Public enforcement actions can damage client confidence and business relationships

Best Practices for SEC Rule 17a-4 Compliance

-

Implement a Comprehensive Record Retention Policy

Create written policies that clearly define what records must be kept, for how long, and in what format. Don’t leave this to chance or individual interpretation.

-

Use Technology Wisely

Invest in proper document management systems that can:

- Automatically capture and archive communications

- Organize records by type and retention period

- Provide audit trails for document access and changes

- Ensure WORM compliance for electronic storage

-

Train Your Team

Make sure everyone understands their record-keeping responsibilities. This isn’t just the compliance officer’s job — it’s everyone’s responsibility.

-

Conduct Regular Reviews

Periodically review your record-keeping practices to identify gaps or areas for improvement. Don’t wait for an SEC examination to discover problems.

-

Plan for Examinations

Organize records in a way that makes them easy to locate and produce during regulatory examinations. Create master indices and know where everything is stored. My RIA Lawyer offers SEC mock exams to help firms prepare.

Getting Professional Help

Books and records compliance isn’t something you want to figure out as you go. The stakes are too high, and the requirements are too complex.

Consider working with compliance professionals who understand the nuances of SEC requirements and can help you:

- Develop comprehensive record retention policies

- Implement proper technology solutions

- Train your staff on compliance requirements

- Prepare for regulatory examinations

My RIA Lawyer Keeps You Ahead of SEC Rules

SEC Rule 17a-4 and similar books and records requirements aren’t suggestions — they’re mandatory compliance obligations that can make or break your firm’s relationship with regulators.

Getting this right requires more than good intentions. It requires proper systems, clear policies, ongoing training, and regular oversight.

Don’t let poor record-keeping become the reason your firm faces regulatory action.

If you’re struggling with books and records compliance or want to ensure your firm is properly prepared for SEC examinations, consider outsourcing your compliance function to the compliance nerds who live and breathe these requirements.

Your clients trust you with their financial future. You can trust us to keep you in compliance. Contact My RIA Lawyer today to discuss your compliance needs.